Credit Union Marketing 101: It’s Okay to Pivot

Do you remember that episode of Friends where Ross purchases a new couch but doesn’t want to pay the delivery fee? Remember, he convinces Chandler and Rachel to help him carry said couch up the stairs to his apartment. It seems to be working fine until they get up the first set of stairs and start to turn the couch to make it up the next set of stairs. That’s when Ross starts yelling, “PIVOT. PIVOT. PIVOT.”

It’s at this point where the couch starts to slip, and Chandler and Rachel begin to realize Ross’ idea of carrying this couch up the stairs is a terrible idea. It’s hilarious to watch, but I also feel for the three friends because I know what it’s like to plan for something only to need to make a mid-course correction, or pivot, later on. That’s one of the many things I love about marketing, though — it’s okay to pivot.

As the marketing and business development director for Vizo Financial, I know that marketing can be challenging sometimes, but it’s vital in furthering our movement, so I thought I would be a friend and share just a few things about the basics of marketing that I believe could be beneficial to your credit union.

Sometimes there’s some confusion around what marketing actually is, and it can often be confused with advertising and public relations. While it is similar, marketing is promoting the products and services your credit union has to offer, and it’s beneficial for so many reasons, like these:

- It increases your brand awareness and recognition. Your community will know you exist, and when people see your credit union’s name or logo, they’ll be able to immediately recognize who you are and what your purpose is. This will help you be top-of-mind for anyone in your community who is looking for a financial institution.

- It brings in more members. As you know, people want to know the institution that they are trusting to handle their personal loan, mortgage or even, simply, their money. You can utilize marketing to show potential members who you are and why they should choose your credit union over a bank or another financial institution.

- It enables you to reach specific potential members in your community. When done correctly, the effort that you put into marketing will reach the people that you want to join the credit union. If you’re wanting to attract a younger generation, you can create a marketing plan to do so. If your goal is to attract families who are looking for mortgages in your community, you can tailor a marketing plan for that as well.

The key to marketing, though, is understanding your target audience — the people who are most likely to want your products and services. You need to know their:

- Wants

- Likes

- Needs

- Preferences

You also need to know:

- Where they spend most of their time

- How they like to receive information (video, graphics, words, etc.)

- What resonates with them the most

- Who influences them to make decisions

You also need to know what channels they utilize the most. Some of these channels may include email, social media, videos, tradeshows, etc. If you don’t know this type of information about your target audience, then survey them or pull data from what you’re already doing to see if it’s working. If you’ve done this in the past, it doesn’t hurt to do it again and do it often. People change, times change and preferences change, so make sure you stay updated to continue to understand your target audience.

Now that we know exactly what marketing is and why it’s beneficial, let’s talk about a few strategies that you can utilize when marketing your credit union.

Search Engine Optimization. This is also commonly referred to as SEO, and it’s basically just ensuring that you’re using key words on your website, blogs, etc., so that when potential members are searching Google for things like mortgage loan rates, personal loans, etc., your website is well-positioned to appear on the first page of their Google search. This is going to take time and research. You’ll need to understand what your target audience is looking for in order to know what key words to use.

Social media marketing. This is simply promoting your credit union and your products and services on social media channels like: Facebook, Instagram, Twitter, YouTube, etc. It’s important to mention that you should research to see where your target audience is spending most of their time and then concentrate on those platforms. For example, your credit union probably doesn’t need a Facebook page if most of your target audience is on Instagram and Twitter.

Email marketing. When you send a promotional email to your members about new personal loan rates or auto loans, you’re engaging in email marketing. This is a great way to generate leads for your other products and services because email marketing is extremely effective. However, you need to make sure that you’re following the CAN-SPAM Act when you’re using this strategy because violations can result in very harsh penalties.

Word-of-mouth. Word-of-mouth is a powerful and simple strategy that your credit union can utilize. Ensuring that you’re providing members with exceptional service and advertising your products and services to them, even if they may not be in a position to utilize those products or services, could help you reach potential members and increase your brand awareness. Think about how often you read reviews for the products you buy, or how often you ask your friends and families for recommendations. Your members are doing this too, so make sure that you’re presenting your credit union in a way where your members want to recommend you to their friends and families.

Content marketing. Content marketing is when you’re providing the answers to questions or the solutions to problems through creative content. This can be done through blog articles, infographics, whitepages, etc. The goal is to create something of value for your members that show that you’re an expert in your field. This could look like a blog article about how to create a household budget or an infographic that shows the process of getting a mortgage loan.

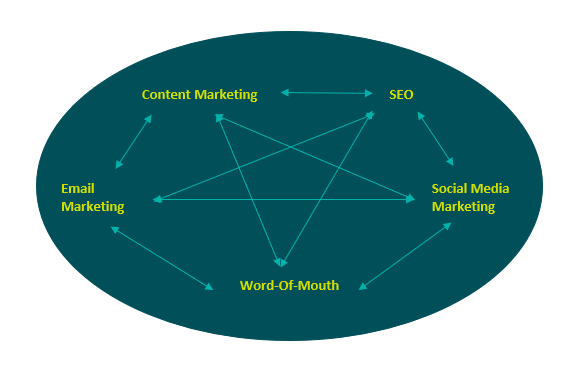

These are all great strategies that you can implement to market your credit union, products and services; but to increase the likelihood that your marketing efforts are successful, you should try and connect each of these strategies to increase visibility.

For example, when creating content for content marketing:

- Add in key words for SEO

- Post your blog articles, infographics, whitepages, etc. to your social media accounts

- Send out emails letting members know that you have new content for them, if they’ve given you permission to send these emails to them, of course

Once your members explore your content, if they found it valuable, they’ll be more likely to share it with others they know through word-of-mouth. You can also add your website, social media accounts and links to other content when you’re creating new content. When you connect all of your channels like this, it’s called omnichannel marketing.

Now, whether you choose to take the omnichannel marketing route or just one marketing strategy at a time, you need to ensure you’re including a call to action (CTA) at the end of every piece of marketing material you create. If you’re creating an email campaign and your goal is to get a member to reach out to your credit union about obtaining a credit card, tell them to do so at the end of emails. If you’re creating a social media campaign and you want members to visit your branch, tell them to do so within each post you create. The goal with a CTA is to entice your member or potential member to take action.

It's also important to point out that you need to be able to measure your success from your marketing efforts, which can be challenging sometimes. You’ll need to create some goals for your campaigns and then measure and/or track those metrics so you can see if your efforts are successful or not. If you see that you’re having success, keep doing what you’re doing. If you see that your efforts aren’t gaining the traction you were hoping to see, don’t be afraid to change your plan and try something new. Or, as Ross says, PIVOT!

You will never know unless you try because marketing is a lot of trial and error, and you have to be willing to take a chance on something new in order to figure out what works best for your credit union. Just remember, it’s okay to pivot and make mid-course corrections, whenever needed. And if you have any questions, feel free to email marketing@vfccu.org because Vizo Financial will always be there for you. 😉

As the marketing and business development director for Vizo Financial, Jaime Agostino oversees the marketing, communication, social media and advertising programs for the Corporate, in addition to the member relations activities. Ms. Agostino holds a Bachelor of Science degree in marketing from the Pennsylvania State University. She currently holds her Series 7 (Registered General Securities Representative) and Series 63 (Uniform Securities Agent State Law Examination) investment licenses from the Financial Industry Regulatory Authority (FINRA), and has also achieved the following professional designations: Certified Trade Show Marketer (CTSM) and Credit Union Development Educator (CUDE).