ALM Management: Less is More or More is Less?

Growing up, I frequently heard the famous quote from Ludwig Mies van der Rohe, “Less is More”. Maybe you did too. But for me, as a child, this phrase did not resonate with me. Why wouldn’t you put all the possible toppings on an ice cream sundae? It just didn’t make any sense to me. Interestingly enough, as I’ve aged, I’ve found that we still apply this “less is more mentality” to other topics, including our asset liability management (ALM) platforms.

Often times, credit unions come to me asking: isn’t less more? They usually say this in conjunction with the question…why run extra models that my examiner isn’t asking to see? These are valid questions because after all, what happens if you run the extra models and you receive more exam questions about them? Most people who ask these questions have the same mindset when presented with this possible scenario…no, thank you. That’s just inviting more scrutiny!

Now, while I can understand this thought process, I’d like for you to consider how more can be less in ALM. Let me explain. Extra models can help you better manage your interest rate risk and plan for earnings, which we find applicable in two ways: Yield Curves and Dynamic Growth.

Yield Curves:

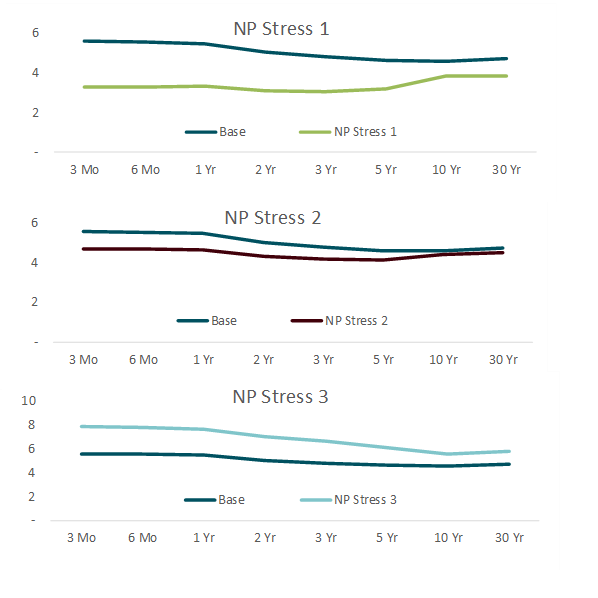

First, let me ask you a question. When was the last time the yield curve moved the same amount on all spots on the curve? If you’re confused, that’s probably because it’s a trick question. The answer is never. You see, the examiner wants to see parallel rate shocks modeled because it shows an extreme level of risk. But when it comes to managing your credit union, why would you rely on a yield curve that won’t happen?

To appropriately manage your earnings and long-term net economic value (NEV) risk, alternate non-parallel yield curves should be evaluated. These should look at the various risks when moving both the slope and level of the curve. Evaluating rising and falling rates as well as shifts in the yield curve helps fully assess the risk to earnings on the curve to give a more realistic view. Not only will it assist with planning earnings expectations, but it’ll also assist with valuation risk.

Dynamic Growth:

Here’s another question for you: When was the last time your balance sheet remained flat…in all accounts? Again, it’s a trick question because the answer is never. The examiner also directs this assumption because they want a way to see the current balance sheet composition. If a dynamic forecast is used, then it becomes hard to verify the growth. Now, while I can appreciate the examiner’s perspective for their unique role, if you aren’t modeling a dynamic forecast in addition to the static, then you’re unable to see the earnings impact of your planned balance sheet shifts. If you’ve taken the time to prepare a strategic plan and are implementing it, then it makes sense to run it through the model as well to help evaluate the earnings risk in various scenarios.

In addition to understanding your earnings risk, dynamic growth should also be evaluated for liquidity risk. After all, if we are unable to fund the strategic plan, it’s best to understand this before implementation to allow either additional funding sources or a plan revision.

It’s also important to keep in mind that in both models, the yield curve or the forecasted growth will never be precise. However, it will provide additional information to allow a deeper understanding of the risk.

Here at the Corporate, we’re seeing a marked increase in credit unions taking advantage of the benefit the model can provide over regulatory compliance. These credit unions are not only taking charge of their growth and earning capabilities, but they’re also showing their exam team the thoroughness of their strategic plans. These credit unions are applying the power of the model to forecast their future success.

For the most part, I still believe less is more, especially when it comes to my current topping preference for an ice cream sundae, as I enjoy the simplicity of hot fudge and whipped cream. As far as ALM goes though, I venture to twist the old adage to “More is Less”.

The ALM model is a powerful tool to elevate the planning process, allowing more analytics to push better decision making. The more you model and understand the risks on your balance sheet, including yield curve shifts and dynamic forecasts, the less uncertainty surrounds the balance sheet management process. This practice will fully prepare you for both your exam and ALCO meetings. I encourage you to use the model to its fullest to gain the best advantage for your credit union.

If you have questions about ALM or the ALM model, please contact our ALM department at almservices@vfccu.org. We’re here to partner with you and help you with your ALM needs.

Melissa Scott serves as Vizo Financial’s vice president of ALM services. In this role, she is responsible for managing and providing ALM reporting, modeling, validation and consulting services to credit unions. She is also responsible for providing ongoing training, support and education for ALM users, management and their board of directors. She also holds the designation of certified public accountant (CPA) and is a member of the North Carolina Association of Certified Public Accountants.