A Look Ahead: Rate Expectations

The market widely expects the Federal Reserve to begin cutting rates in September of this year, but the big question is, how much will they cut? Right now, Fed Fund Futures is pricing in a 100 percent chance of at least a 25 basis point (bp) reduction, and a 59 percent chance of a 50bp reduction.

As we’ve seen, though, there’s been a disconnect between market expectations and what the Fed is telling us. Earlier in the year, the market was predicting as many as six interest rate cuts in 2024. This was in opposition to the message from the Federal Reserve, which was telling us we may see higher rates for longer, depending on the data. Could we be seeing a similar disconnect now?

The FOMC is telling us that rate cuts are on the horizon but have not given any indication that they are considering a 50bp reduction in September. A key takeaway from chairman Jerome Powell’s most recent remarks is, “if we do get the data that we hope we get, then a reduction in our policy rate could be on the table at the September meeting.”

Prevailing Predictions

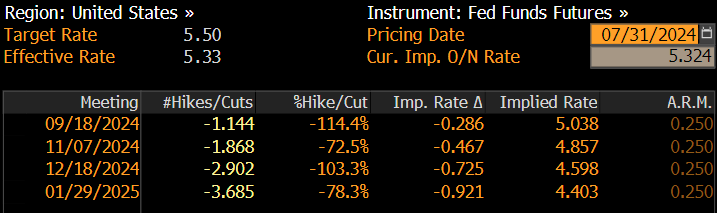

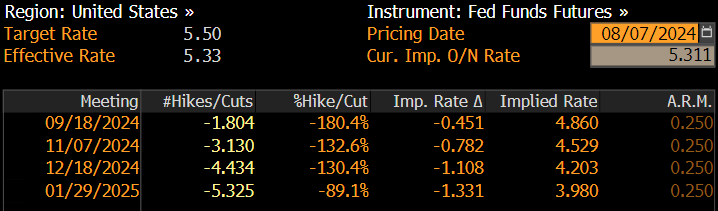

We had seen a drastic shift in market expectations from the time of the last FOMC meeting on July 31, 2024, and one week later on August 7, 2024.

As the charts above reflect, the market expectations took a sharp turn after the latest July employment report was notably weaker than expected. Some feared that the weak employment numbers were a sign of a potentially larger economic issue and started calling for the Fed to cut more aggressively than previously expected. We need to remember that the reason the Fed raised rates to their current levels was to cool things off and bring inflation to an acceptable level. A weakening labor market may just be a sign that the higher rates are starting to have the intended effects.

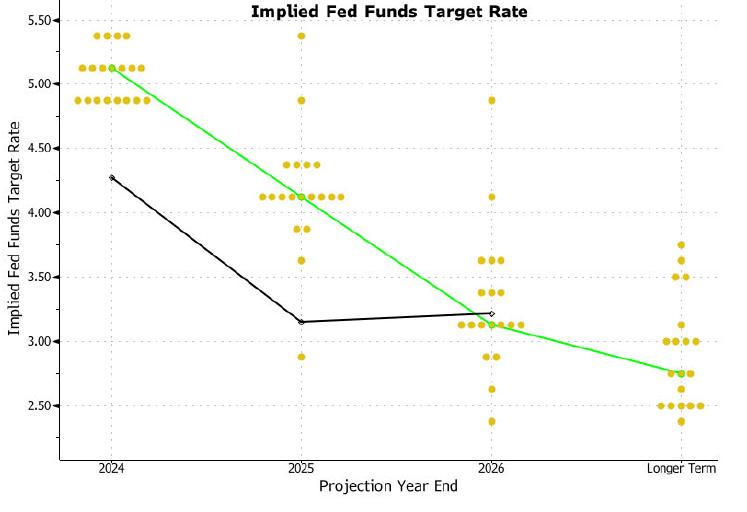

If we look at the latest DOTS plot released by the Fed, they are calling for one to two rate cuts before year end. This data is based on the June 2024 data, and the September data may signal the Fed is inching closer to what the markets are predicting. Even if the September data shows the Fed is falling more in line with market expectations, it’s hard to believe that they will go against what they have been saying all along and start to cut rates rapidly.

Watch the Data & Tailor Your Strategy

Incoming economic data will be closely watched to see if the recent employment data was a sign of a more significant economic downturn on the horizon or just employment conditions starting to normalize. If the economic data continues to show progress toward the two percent inflation goal with only a slight slowdown in economic activity, we may end up getting the soft landing that the Fed has been aiming for. In this scenario, we will see a gradual reduction in interest rates. If the data comes in significantly weaker, we may see the Fed react with more urgency, and a recession could be waiting around the corner.

From an investment standpoint, we have been telling credit unions to extend duration and lock in rates before yields fall. Although yields are down significantly from their peak levels, there is still time to lock in before they continue to fall. The market will remain volatile, so look for buying opportunities when they arise. As always, if you need investment assistance, please reach out to our team at investmentsales@vfccu.org.

Roger Heidlebaugh serves as Vizo Financial’s portfolio strategist. He acts as an investment consultant for credit unions, helping them to manage their fixed income investments, jumbo CDs and deposit accounts. On the corporate side, he analyzes, monitors and facilitates liquidity funding and investment solutions for Vizo Financial. Mr. Heidlebaugh is well-versed in the financial services industry, with over 14 years of experience as a financial advisor and expertise in managed accounts, various annuities, life insurance, investments and more.