The Fed's Battle Against Inflation: Challenges or Opportunities?

Over the past year, we’ve seen an epic series of interest rate hikes by the Federal Reserve that began in March 2022. So much so, that some debate remains on whether we’ve seen the last rate hike or if the Fed will decide to raise one final time in its latest battle against inflation.

Regardless of which side of the “will there be or won’t there be” line you fall on, most of us believe we are at, or at least very close to, the end of the latest cycle that has sent benchmark borrowing costs to their highest level in more than 22 years. The rapid rise in interest rates no doubt caused a lot of liquidity problems for credit unions, both large and small. After all, it’s been nearly 15 years since banks and credit unions have had to compete for deposits by raising rates or offering certificate of deposit (CD) specials.

However, under the current economic environment, the majority of credit unions are being challenged to look for ways to raise liquidity and solidify their contingency funding options. And having the ability to invest funds and take advantage of higher interest rates is a luxury few credit unions currently enjoy.

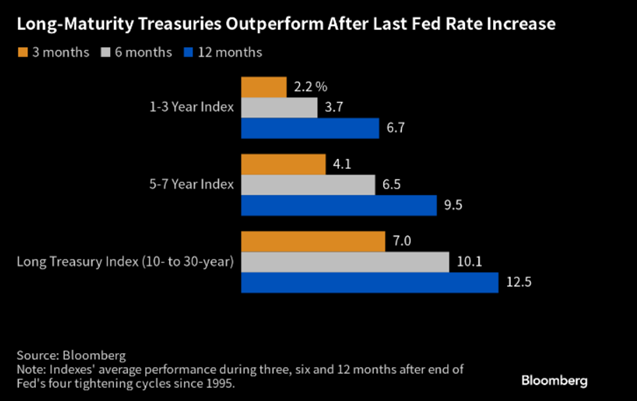

For those credit unions that find themselves in the envious position of having excess reserves that could be invested, now may be the perfect time to put those funds to work. Historically, longer-term investments have outperformed shorter-term investments by a significant amount after the last Fed rate increase in a cycle. The graphic below depicts this by showing long-term treasuries outperforming short-term treasuries by an average of 5.8 percent (12.5 percent vs. 6.7 percent) over a one-year period after the last rate hike in the Fed’s four tightening cycles since 1995.

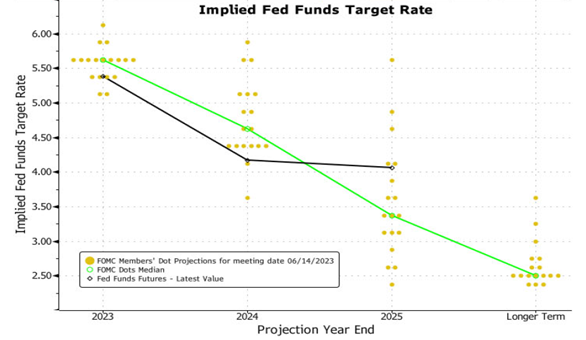

Traditionally, credit unions have favored investments with maturities of 1-36 months. However, with rate forecasts predicting the Fed Funds target rate to be approximately 200 basis points lower by the end of 2025, the option to reinvest at five percent or greater is appearing unlikely. But perhaps your credit union has a diverse investment portfolio that includes agency bonds and mortgage-backed securities, or maybe you prefer to invest primarily in CDs. Whichever the case may be, it probably makes sense to look at increasing the duration of your investment portfolio. After all, economists on Bloomberg are predicting that the Fed will begin to cut rates sometime in early 2024 and believe rates will be about 100 basis points lower by the end of 2024.

That means that now may be the best time to purchase investments with a longer duration. The Fed Funds target rate graph above shows FOMC members are projecting that interest rates beyond 2025 could hover somewhere around 2.5 percent. Because of this, reinvestment opportunities in shorter-term investments may not be as attractive as they are today. That’s why the opportunity to lock in yields that haven’t been seen since pre-financial crisis may not be around too much longer.

Now you may be asking yourself: Should I consider swapping underwater investments for higher-yielding alternatives?

If you’re like most credit unions, you probably don’t have excess cash just lying around like you did in 2021, but you may still be able to take advantage of the higher rates by repositioning your portfolio.

Although we hate the thought of waving the white flag and selling an investment at a loss or taking a penalty from surrendering a certificate early, there are instances where it makes sense. Bond investments and certificates that apply a market-based surrender penalty are typically priced to where arbitrage will be almost impossible.

For example, let’s assume we have a one percent certificate that was purchased in 2021 for $100,000 that has one year until maturity. Then imagine that you just learned about a new, one-year CD at a rate of 5.6 percent and would like an additional 4.6 percent return compared to the current investment. The current investment charges a market-based penalty for early surrender, which would amount to approximately $4,000. By surrendering the current investment and reinvesting the funds at a higher rate, we’d come out at about $300 ahead but wouldn’t recoup the loss from our penalty until the twelfth month.

Instead, we invest in a five-year certificate at 4.9 percent because, in this case, we have approximately $6,500 additional interest income (after the $4,000 penalty is accounted for) in five years compared to reinvesting the original certificate at maturity into four consecutive one-year terms at the implied rates of 4.5 percent, 3.5 percent, 2.5 percent and 2.5 percent.

The Federal Reserve’s most recent battle with inflation has certainly brought some challenges to the credit union industry, but, when looked at from a different perspective, could actually present a potential opportunity.

Now is a great time to evaluate your investment strategy. In addition to helping your credit union evaluate and purchase new investments for your portfolio, Vizo Financial can also help you analyze your current investments and see if it makes sense to make any changes to lock in these higher rates. For more information, contact your corporate account manager or our investments department at investmentsales@vfccu.org.

Roger Heidlebaugh serves as Vizo Financial’s investment analyst. In this role, he acts as an investment consultant for credit unions, helping them to manage their fixed income investments, jumbo CDs and deposit accounts. On the corporate side, he analyzes, monitors and facilitates liquidity funding and investment solutions for Vizo Financial. Mr. Heidlebaugh is well-versed in the financial services industry, with over 14 years of experience as a financial advisor and expertise in managed accounts, various annuities, life insurance, investments and more.