Sallie Mae: A Low Effort, High Impact Student Loan Program You Don't Want to Skip Out On

We've all done it...skipping school is just a rite of passage for every student at some point or another. But as credit unions and providers of student loans, skipping out on easily earned income and an opportunity to give your members a chance at higher education is definitely something you don't want to do. But if you’re not offering a student loan program, that may be exactly the case.

So, how can you change that? And, better yet, how can you do it with little effort, yet high impact?

Step 1: Check out Sallie Mae through Vizo Financial. The Sallie Mae Education Loan program benefits both your credit union and your members who are bound for higher education with features such as easy fee income for your institution, as well as a simple application process and multiple repayment options for members, just to name a few.

This program, through Vizo Financial, is already at your fingertips, and it checks all the boxes of a great student loan program. You see, our partnership with Sallie Mae is meant to help you achieve both of those goals – bringing in extra revenue with relatively little effort on your part while also appealing to your education-minded members and their families. Sounds great, right? Just wait…

Step 2: Spread the Word! In other words, promote your student loan program. Pique the interest of your college-aged members and their families by sharing all the benefits of the Sallie Mae program. How? Catch their attention with the amazing marketing materials available to credit union partners through the Sallie Mae marketing portal.

Here are just a few of the member-facing things you’ll find in the fully-stocked marketing portal:

- Brandable, already approved marketing materials

- Print collateral (posters, buckslips, etc.)

- Online content (ad tiles, web content, social media posts, email templates, etc.)

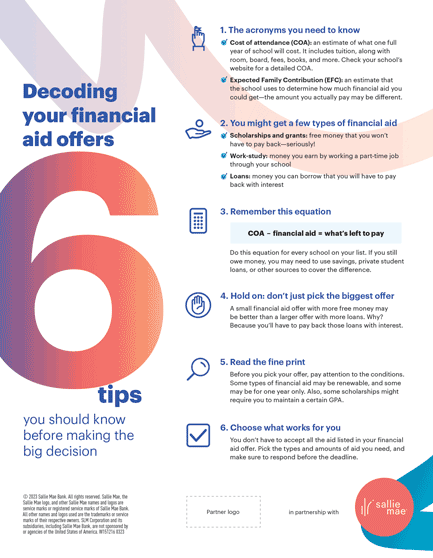

- Education tools, including financial literacy pieces

As for behind-the-scenes content, you’ll find these things in the portal as well:

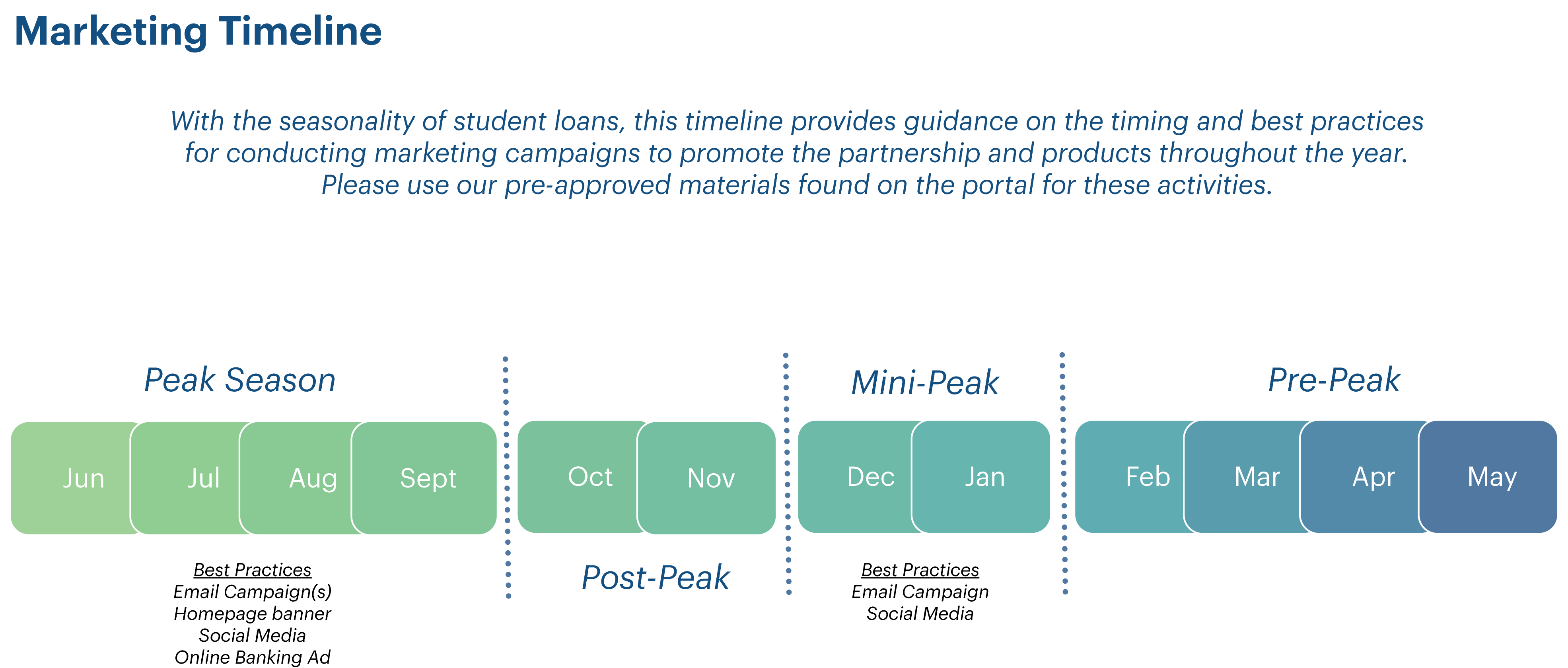

Marketing Calendar

Student loans operate on a special trajectory throughout the year. What’s the best time to promote your credit union’s loan options for peak season? How can you stay top-of-mind before the next peak season begins? The marketing calendar has all these answers and more, which will help you determine timely and engaging campaigns.

Partner Snapshot Report

There’s also a way to see how your student loan initiatives are panning out thanks to Sallie Mae's Partner Snapshot Report. Use this information to get monthly performance updates and compare year-over-year loan volume. This will give you a snapshot of how your loan program is doing and can help you tailor your marketing efforts for maximum success!

Disclosures

Sallie Mae requires specific information to be disclosed as part of student loan program. These disclosures are easy to find and apply to your marketing materials from within the portal.

It’s time to step up your student loan game in 2024. And with Sallie Mae through Vizo Financial, doing so can be incredibly easy, not just because the program is beneficial for both your institution and your members, but also because promoting it is a breeze with the turnkey partner portal.

Learn more about the Sallie Mae program and the portal at our upcoming webinar, Offer Education Loans to Your Members with Sallie Mae, on April 18, 2024, at 10:00 a.m. ET. During the session, we’ll be covering benefits to offering the program, how it works and specifics about the implementation and training process. Get all the details for this webinar from the Upcoming Webinars page of our website, or register using the button below.

Email accountmanagers@vfccu.org to see how you can join in on this low effort, high impact program today…before peak season officially begins!