How Should Your FI Overhaul Your Overdraft Fees?

Banks and credit unions have been making material changes to their overdraft fees and policies with increasing frequency since the middle of 2021.

To date, the national banks, large regional banks and a sprinkling of credit unions have led the charge with announcements that make their public relations providers proud. Community financial institutions (FIs), especially community banks, have pretty much taken a hands-off approach to doing anything to date.

(StrategyCorps is tracking these announcements on a timeline with their respective changes at strategycorps.com/overdrafts.)

The list below shows the specific actions being taken by the FIs who have proactively made changes due to competitive market forces (and most likely some general feeling that the regulators have overdraft fees on their radar screen for increased scrutiny).

- Eliminate overdraft fees (all or selected accounts), 37%

- Lower overdraft fee, 29%

- Increase grace period to cure, 14%

- Increase safety zone (amount of OD), 11%

- Offer flat fee no overdraft account, 9%

- Offer better notification tool, 9%

- Other (namely, eliminate or reduce NSF fees or transfer fees), 9%

(Note: Percentages exceed 100% due to some FIs taking multiple actions)

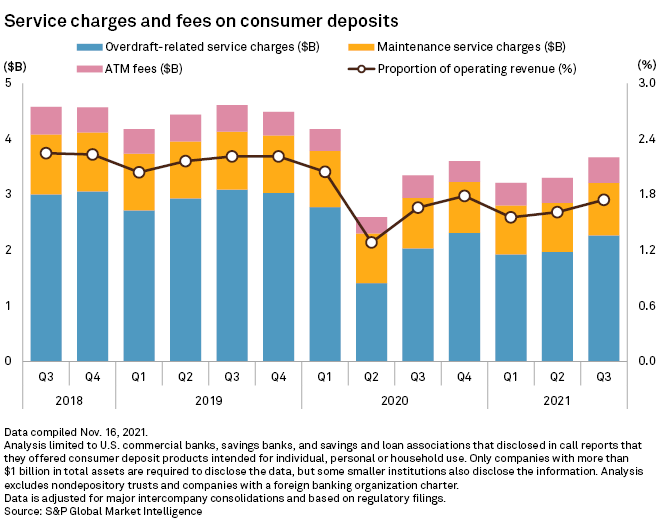

Deciding to materially change your OD/NSF fee pricing and policies is a critical one for financial institutions due to its significant impact on non-interest income. The chart below shows that for banks over $1 billion in assets, overdraft-related fees consistently comprise about 60% or more of total service charges and fees on consumer deposits.

StrategyCorps’ database of nearly 1.1 billion data points related to retail checking performance shows that for FIs less than $1 billion in assets, the reliance on overdraft fees is higher, approaching nearly 60% of total non-interest income.

A further review of overdraft frequency shows that about 82% of a typical FI’s checking account customers do not overdraft at all on an annual basis. About 10% overdraft one to four times and 2% four to six times. Those who overdraft six+ times annually account for just 6% of customers but about 80% of the total annual overdraft fees.

Why is this important in your OD decision-making process? Let’s look at the choices made so far by FIs regarding OD fees and policies.

To date, totally eliminating fees is the most popular decision, albeit skewed by the national and large regionals with much more diverse and plentiful sources of non-interest income than community FIs.

Clearly, if FIs decide to totally eliminate overdraft fees, frequent overdrafters and other selected customers who value the services will go to another FI to overdraft. ODs are a necessary part of their lifestyle, and they will go where they have to go to access and utilize this service.

Practically speaking, this isn’t a viable option as most FIs can’t afford to totally eliminate OD/NSF fees due to their over-dependence on them for non-interest income.

A more interesting dynamic is the second most popular choice to lower the OD fee. This move was pioneered by Bank of America’s move from $35 down to $10 and has been followed by other large banks (Truist and First Citizens).

While it will cost these banks hundreds of millions of dollars of decreased revenue, they can afford to take that hit due to other non-interest sources of revenue. (Also, a possible increase in the number of customers who may more frequently overdraft due to the lower price will help offset this revenue decrease.)

This may entice chronic over drafters at your FI to consider doing business with BofA (or other FIs that lower their fee below yours). With such a high concentration of overdraft revenue from these types of frequently over drafting customers at your FI, keeping your OD fee the same increases the flight risk of these customers.

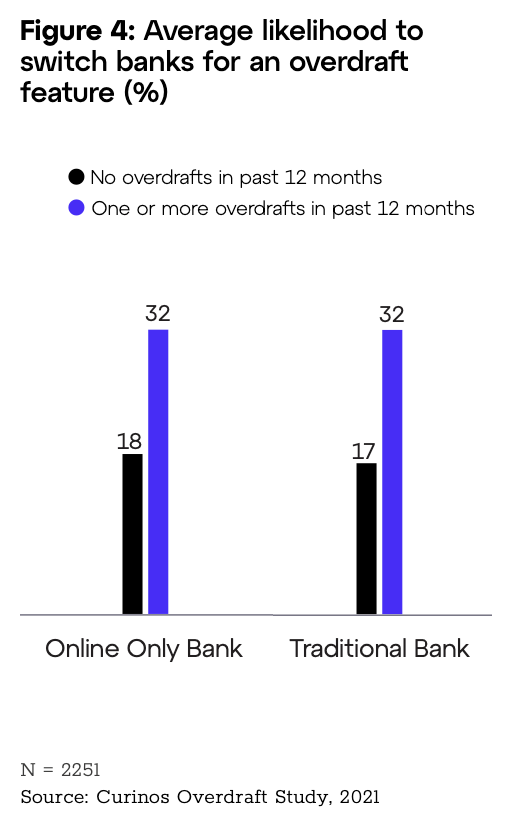

A recent survey from Curinos shows consumers are interested in switching FIs who have made overdraft feature changes.

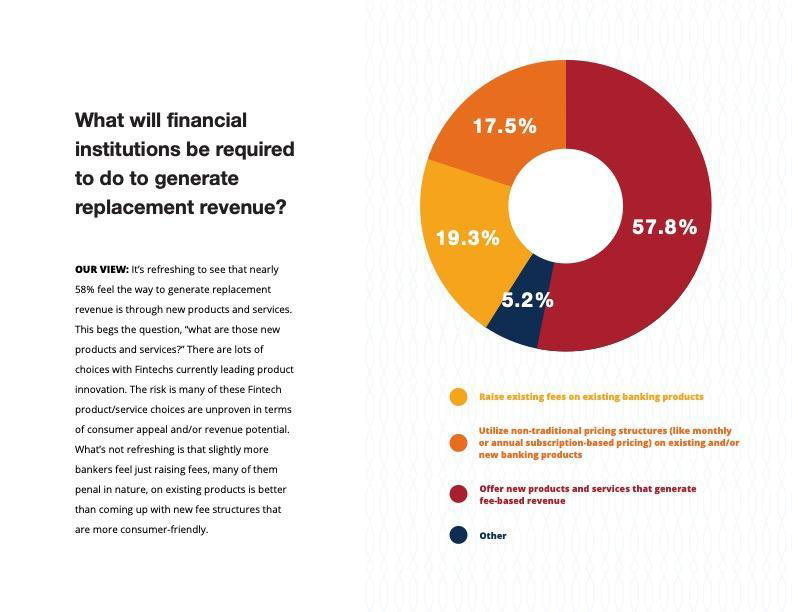

Doing some quick math shows that a decrease in an average OD fee somewhat similar to BofA’s price reduction results in a large amount of replacement revenue that must be found from other sources. A StrategyCorps survey of bankers in September of 2021 showed the following chosen alternatives to generate replacement revenue:

Just as importantly, BofA has set the benchmark for market pricing for regulators.

This move essentially addresses the core issue: ODs are not bad and provide a valuable service; the amount of OD fee is “unfair” based on the underlying cost of the FI to provide it and that the financially vulnerable are the primary users of this high-margin product. The benchmark fee reduction by BofA and other large and prominent FIs will make it difficult for smaller FIs to defend their position with regulators that a price point well above $10 is fair.

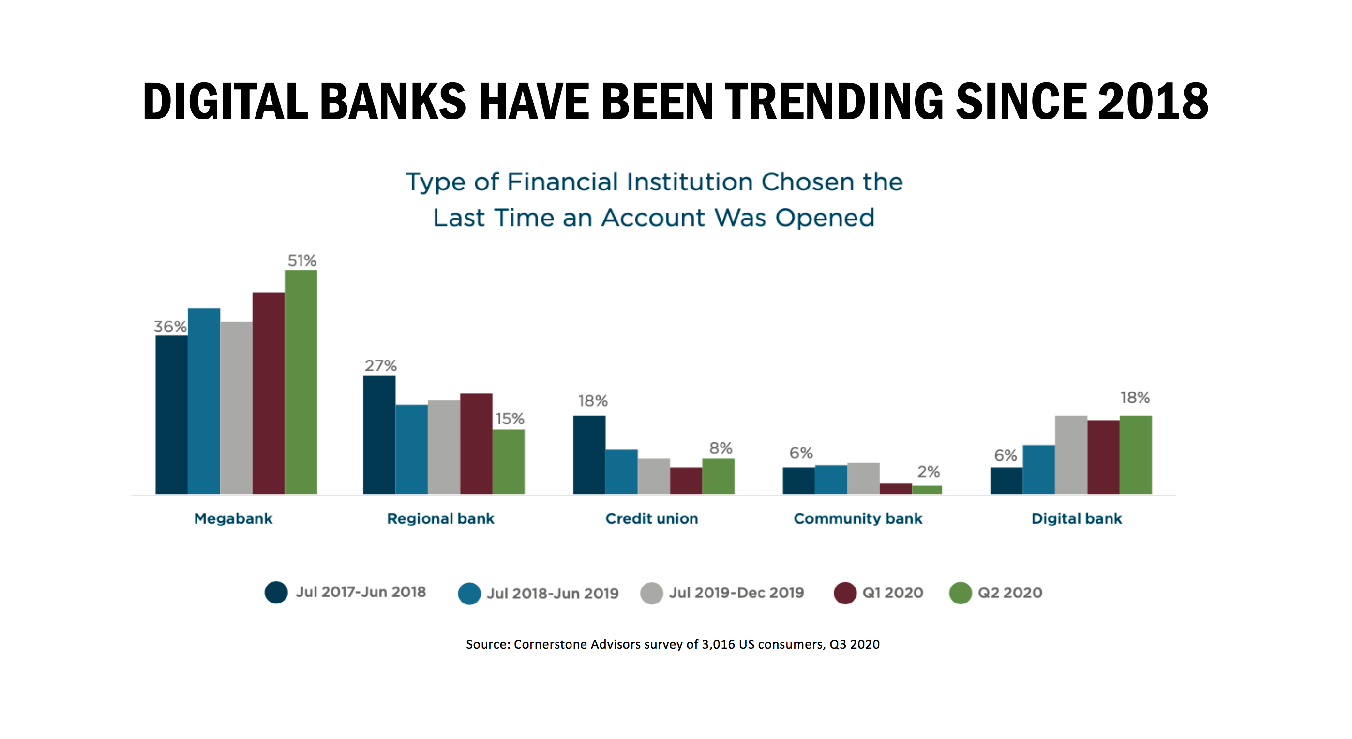

The remaining choices above, (except for a flat fee, no overdraft account) are being more effectively employed by the digital banks from the very beginning of their existence as a competitive product feature advantage against traditional FIs.

Chime, Revolut, MoneyLion and others have been gaining material market share at the expense of community banks and credit unions by providing more attractive overdraft features to their customers that make their checking products appear superior.

This advantage is shrinking as more traditional FIs are beginning to offer similar features to match these digital banks.

Even if “wait-and-see” is your current attitude towards overdrafts, at some point soon, your FI is going to have to make changes due to these competitive market forces and/or possibly more regulatory pressure.

Your decision of what OD pricing and policy changes to make and what replacement revenue alternatives to implement will be the most important decision regarding your FI’s non-interest income generation for years to come.

For info on all the FIs that have announced changes and to download the results of our latest survey of bankers about these NSF/OD changes, visit our Overdraft Watch page.

Mike Branton is a financial expert and partner at StrategyCorps. You can connect with him at mike.branton@strategycorps.com.