Do SBA Variable Rate Pools Make Sense for Your Credit Union?

When rates are high and you’re looking to lock in yield, fixed rate investments are generally the way to go, especially when rates are expected to fall. This has been the case since the end of 2023, and credit unions have been adding fixed rate investments ever since. Many credit unions have continued to add duration to their portfolios even after the Federal Reserve began cutting rates in September of 2024.

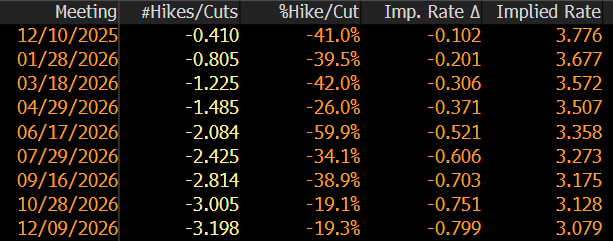

As of mid-November, Bloomberg is predicting three additional rate cuts (a total of 75 basis points) between now and the end of 2026. This is not a certainty, as inflation still poses a threat to the economy and some on the Federal Open Market Committee are publicly stating that additional rate cuts are not a sure thing.

Even with the high potential for rate cuts on the horizon, one of the biggest risks credit unions face when locking in longer-term investments is interest rate risk. Interest rate risk primarily affects fixed-income securities, as their price has an inverse relationship with interest rates. When interest rates rise, the value of the bonds you are currently holding will fall. For this reason, a lot of credit unions that purchased bonds at low interest rates during and shortly after the pandemic are still seeing major losses on their balance sheets.

How Do We Combat Interest Rate Risk?

One way to combat interest rate risk is to limit the duration of your portfolio. The easiest way to do this is to limit the length or term of your investments. Purchasing securities that mature within 12 months will certainly limit your interest rate risk, as these investments are less sensitive to fluctuations in interest rates compared to longer-term investments. The downside to this strategy is that you are limiting the yield you can make on your investment portfolio, as shorter-term investments will generally yield less than their longer-term counterparts. Another way to mitigate interest rate risk is by purchasing securities that have a variable coupon rate. With these securities, the interest you receive will adjust or “float” with a specified benchmark. With that, let’s take a more detailed look into a specific type of variable rate investment, SBA 7(a) variable rate pools.

What Are SBA 7(a) Floaters?

SBA pools are comprised of loans that an SBA approved lender originates to small businesses. Each loan in the pool is guaranteed by the U.S. Small Business Administration (SBA), typically covering 75-85 percent of the loan value. Lenders then sell guaranteed portions of the loans and retain unguaranteed portions and servicing. Assemblers then purchase guaranteed portions of the loans from originators and form SBA pools.

Benefits of SBA Pools as an Investment

SBA investment pools offer a variety of benefits, such as:

- Government Guarantee: SBA pools have principal and interest fully guaranteed by the U.S. government (zero risk weighted).

- Interest Rate Risk Management: Pools float quarterly with a prime +/- margin and generally have no caps. This can be particularly useful in a rising interest rate environment because the interest rate is tied to a benchmark, providing a hedge against rising rates.

- Attractive Yields: SBA pools typically have floating spreads that are competitive with comparable short and long-term investments.

- Income Stream: Investors in SBA pools receive regular payments of principal and interest, somewhat like a mortgage-backed security investment. The payments in SBA pools come from the small businesses who are repaying their loans. In addition, certain types of SBA loans to small businesses carry a prepayment penalty in the first few years. This helps investors in SBA pools minimize some of the prepayment risk associated with other types of amortized investments.**

Considering SBA? Remember This…

Credit unions should consider SBA floaters because they offer a way to earn attractive, government-guaranteed income, diversify their investments and manage liquidity and interest rate risk. They provide a stable, floating-rate investment that is fully guaranteed by the U.S. government, which is especially beneficial in a rising interest rate environment.

Talk to your broker or investment professional to determine if an investment in SBA pools makes sense for your credit union. We’re always happy to help here at the Corporate!

Roger Heidlebaugh serves as Vizo Financial’s portfolio strategist. He acts as an investment consultant for credit unions, helping them to manage their fixed income investments, jumbo CDs and deposit accounts. On the corporate side, he analyzes, monitors and facilitates liquidity funding and investment solutions for Vizo Financial. Mr. Heidlebaugh is well-versed in the financial services industry, with over 14 years of experience as a financial advisor and expertise in managed accounts, various annuities, life insurance, investments and more.