A Look Ahead: Expectations for the Markets & Economy in 2024

You’d think after nearly four years of pandemic-induced financial hysteria, we would’ve seen it all. But that wasn’t the case – not even close – as we continued to weather many storms in 2023. As 2024 closely approaches and we try to prepare ourselves for what’s next, we must look ahead and see what expectations are for the markets and economy.

Economy Past

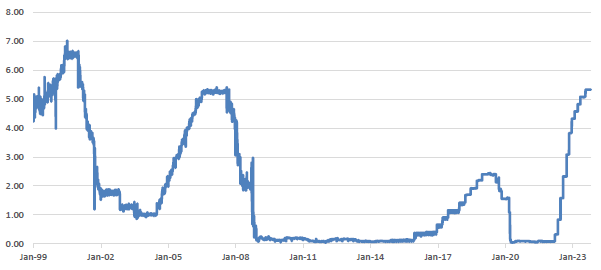

We entered 2023 with the FOMC aggressively raising the overnight rate at a pace not seen in decades. Inflation readings had fallen from their peaks, but were still above six percent on an annual basis, and the Fed still had work to do to get to their two percent inflation target. No one knew if consumers would continue to spend and if employment would remain strong throughout the year, adding to a real chance of a recession.

As we close out 2023, the economy appears to be in good shape. It continues to generate new jobs, more people are re-entering the workforce, GDP is strong (4.9 percent as of the third quarter), and all underlined by a resilient consumer. Inflation has fallen dramatically from its peak of a year or so ago, but there are warning signs of trouble ahead.

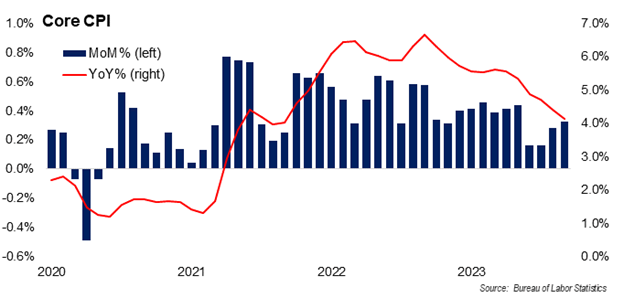

While inflation has fallen dramatically from its peak, current readings are still above the Fed’s two percent target and the trend of quickly falling inflation has ceased. The headline reading for consumer prices (CPI) fell to 3.0 percent year-over-year in June but have since risen back up to 3.7 percent year-over-year. The Fed’s preferred measure of inflation, personal consumption expenditures (PCE), fell to 3.2 percent year-over-year in June but have since climbed up to 3.4 percent year-over-year. The PCE core reading, which excludes food and fuel prices, has shown steady downward progress, but the most recent reading still stood at 3.68 percent year-over-year. While much work has been done to reduce inflation, there is still more to do to get to the Fed’s two percent target.

Economy Present

The FOMC met on November 1, 2023, and for the second consecutive meeting, held the overnight rate steady at 5.25 - 5.50 percent. The last time the Fed raised rates was at their July 26 meeting. In Chairman Powell’s press conference following the meeting, he told us the Fed was comfortable holding rates steady and they would continue to make decisions based on incoming data. The Fed was happy with their progress on lowering inflation and wants to give time for prior rate increases to work their way through the system, something that is thought to take six to nine months to do.

He also cited the recent rise in longer-term market rates, which had the same effect as a rate increase by making credit harder to obtain. In terms of mortgages, 30-year rates are approaching eight percent and the subsequent slowdown in mortgage originations backs this up. The Fed has one more meeting this year, on December 13, and will have two more readings on inflation to look at, plus two more employment readings to digest. If inflation continues to track higher and the unemployment rate remains low, the Fed could raise rates once more at year-end. However, the markets proxy for future Fed rate moves, Fed Fund Futures, are currently only giving five percent odds for a December rate hike.

Economy Future: 2024 Economic and Rate Projections

The markets and the Fed agree the likelihood of a recession in 2024 is slim. The Fed is not currently building a recession into their 2024 outlook, and market surveys show a belief that the U.S. economy will achieve a soft landing in 2024. It’s hard to believe considering where we’ve come from since the start of the pandemic when job losses were rampant and consumer spending slowed because of the government’s shut down of the economy. Prior experience in dealing with high inflation shows a soft landing will be historically difficult to achieve, but recent government spending could change things.

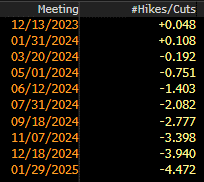

The chart below shows the markets’ current expectations for Fed Funds through 2024. As you can see from the chart, the markets don’t think the Fed is going to hike rates again this cycle. They give the highest odds of another rate hike at the January meeting, but the odds are very low. The markets currently have a bias for rate cuts and are projecting they’ll start sometime in the second quarter of 2024, a belief at odds with the Fed’s higher for longer mantra. From the chart below, market projections predict a 25 basis point cut at either the May or June meeting and a total of almost 100 basis points of cuts in 2024.

The markets’ longer-term yield expectations are also showing a drop throughout 2024, as shown with forward rate projections below. On the left-hand side, you will find the term and if you follow across the row, you will first see the current rate (spot) and projections for terms of one month, three months, six months and 12 months. These projections are of November 3. All terms are expected to see drops in yields six months from now and a year from now, with the largest drops coming for the shorter terms. The 10-year yield is expected to hold up better as the markets project the Fed will cut overnight rates, pushing down short-term yields and normalizing the yield curve, which is currently inverted.

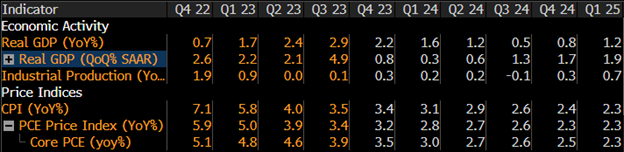

The latest economic survey by Bloomberg shows expectations of positive GDP growth throughout all of 2024 and heading into 2025. By traditional standards of using two or more quarters of negative GDP, this would indicate they aren’t anticipating a recession. Instead, the markets and the Fed are anticipating a soft-landing scenario.

Predictions for Credit Union Financials

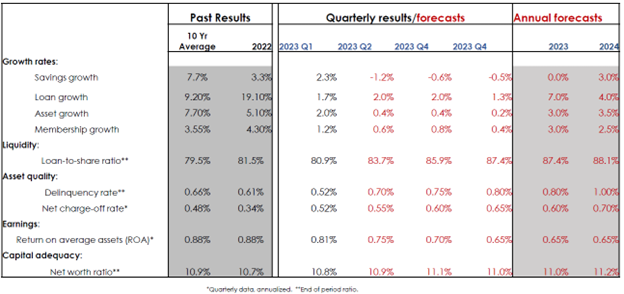

CUNA’s latest forecast for credit unions (from August 2023) projects slowing loan growth and higher savings growth in 2024 compared to 2023. However, loan growth is still expected to grow at a higher rate than savings growth, which will further tighten credit union liquidity. This view aligns with the trends we’re currently seeing and with the projections we have for cash balances in 2024.

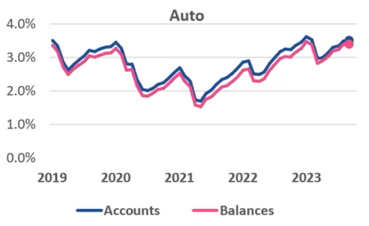

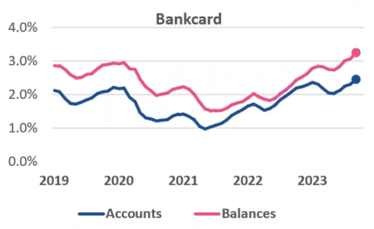

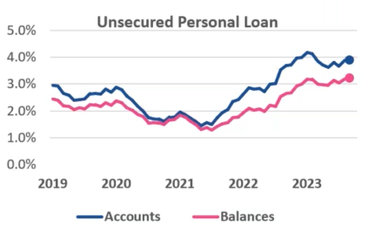

In addition, CUNA also projects higher loan delinquencies and charge-offs in 2024, which would continue the recent trends that we’re already seeing in the U.S. The charts below from Experian show the recent trends of 30+ days delinquency for various loan types.

Final Thoughts

While, sadly, there is no crystal ball to show us a clear path for the future of credit union financials, the markets and the Fed are projecting a soft economic landing next year, despite some warning signs that it may be hard to achieve. Credit trends have been more negative recently, with delinquencies and defaults heading higher. This is happening as borrowing has become more expensive and harder to get. On the positive side, consumers continue to spend and could keep the economy strong. Job growth has also been a bright spot this year even with the most recent reading, which was negatively impacted by the United Auto Workers (UAW) strike.

The Fed seems comfortable with a longer pause in rates and is giving themselves time to see how the economy reacts to previous rate increases. They’re hopeful inflation will continue to fall and get closer to their two percent target while the economy remains strong. Recent inflation trends would indicate this may not happen on its own, so the Fed may not be done hiking rates. But it does appear we are close to the peak in rates for this cycle. With the rate and economic ambiguity heading into 2024, it will be useful to pay attention to what the Fed and FOMC members are saying. They have been transparent during the current tightening cycle, which should continue as we reach this period of uncertainty.

Scott Wood is Vizo Financial’s SVP/chief investment officer. He is a NASD-registered representative, responsible for assisting the investment and liquidity needs of member credit unions.