Short-Term Maturities versus Long-Term Maturities: Why Now is the Time to Go Long

You may recall that in the years following the financial crisis, investors were forced to choose between bad and worse when it came to investment rates. That all changed when the Federal Reserve began their aggressive battle against inflation in March of 2022, and credit unions were finally able to invest at advantageous rates again. Even now, two years later, credit unions are still able to invest at rates of five percent or higher. In fact, we’re getting used to seeing daily investment offerings of five percent or higher, and those of us who can take advantage, are. But as the old adage goes, “all good things must come to an end.”

The Current Economic Outlook:

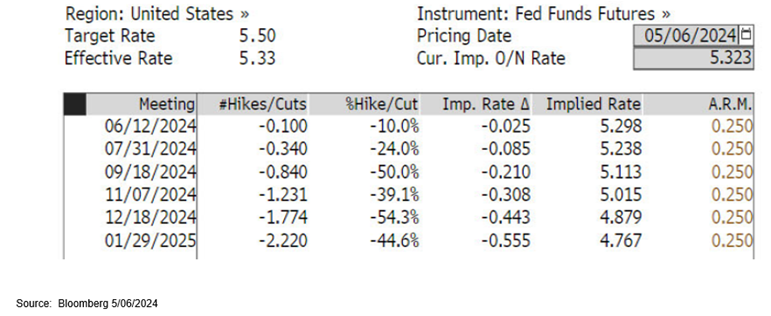

Right now, the general consensus is that the Federal Reserve is done raising rates, and most are predicting at least one rate cut this year, possibly more. However, when the Fed will begin to cut rates and how quickly they’ll cut them is by no means a certainty right now. Incoming economic data will surely dictate the pace of the Feds actions. Currently, the market says there is an 84 percent chance that the fed will cut on or before the September 18 meeting later this year.

If you’re someone who finds it difficult to trust or believe what the market is saying, even the Federal Open Market Committee (FOMC) members are predicting two interest rate cuts this year. According to the most recent dot plot, FOMC participants are also predicting three rate cuts by the end of 2025. So, it’s safe to say that rates will be lower 12 and 24 months from now.

The Value of Long-Maturity Treasuries:

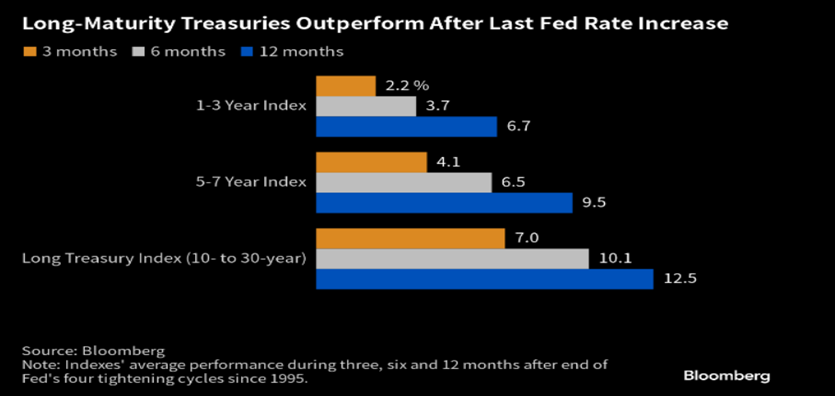

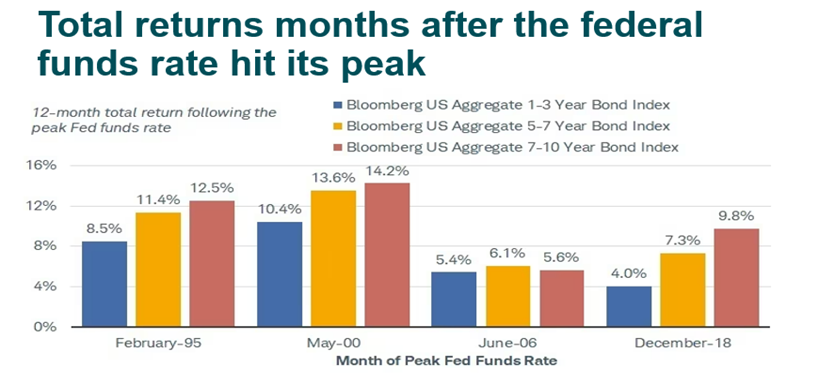

With this news, portfolio managers have increased holdings on long-duration U.S. Treasuries. This is because longer maturity treasuries outperform shorter maturities after the last Fed rate increase in a cycle. You may be wondering why this is the case.

The reason is actually pretty simple; as rates go down, bonds with an attractive yield for a longer-time horizon are more valubable than those with a shorter-time horizon. If you think back to your college days and your intro to finance classes, you’ll remember that as rates go down, bond prices go up. Bonds with a longer duration will increase in value more so than bonds with a shorter duration.

Generally speaking, all bond prices typically increase as rates decrease. This means that most investments we purchase now, at current rates, should increase as rates begin to fall. In my experience within the financial industry, many credit unions prefer to purchase investments of three years or less. This is usually due to:

- an investment policy that limits how long an investment can be

- the perception that longer-term investments are typically riskier

- the person making the investment doesn’t want to give up a higher current rate of return to lock in a longer-term investment with a lower coupon

Currently, we have an inverted yield curve, which means that short-term rates are higher than longer-term rates, but despite this, it’s still worth considering extending the duration of your portfolio. Why? Because the ability to invest at higher rates…may not be here for long.

Two-Year Treasury Bond Versus 10-Year Treasury Bond:

As we’ve discussed, we know that rates have most likely peaked, and that a rate cut is on the horizon. We also know that rates will be lower 12 and 24 months from now. In addition, we know that longer-term investments will outperform shorter-term investments as these rate decreases are happening.

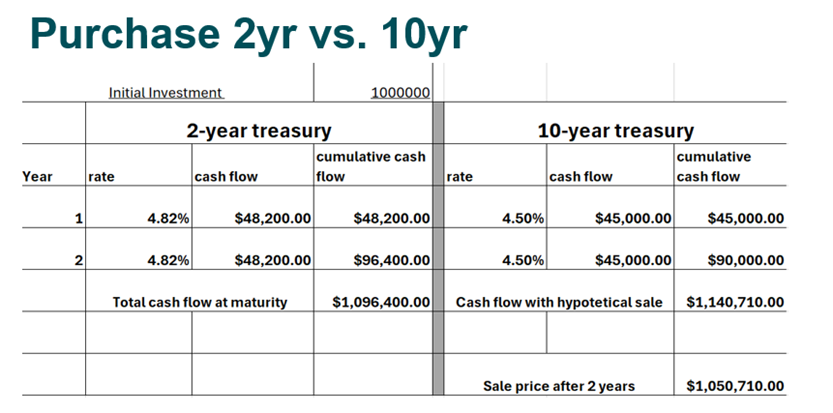

So, “why are we not investing in longer-term investments?” The following illustration is a hypothetical example using the exact figures as predicted by the Bond Yield Forecast function on Bloomberg. In other words, if everything goes exactly how the market predicts it will go, this will be the result. The example looks at investing in a two-year treasury bond versus investing in a 10-year treasury bond and selling the bond after two years.

As you can see by the above example, even though the two-year bond has a higher current yield than the 10-year bond, the 10-year bond will have a higher total return after two years. The reason is because the value of the 10-year bond after two years is projected to be $1,050,710. This is because rates on the 10-year bond are projected to fall from 4.50 percent to 3.76 percent in two years.

With all this in mind, it’s easy to see why now is the time to lock in longer-term interest rates. Even if it means taking a lesser coupon rate now, there are several advantages of adding duration to your portfolio. As rates fall, you will be glad you chose to lock in some of your investments at or near the “peak” of the rate cycle.

If you have questions about Vizo Financial and our investment offerings, please contact us at investmentsales@vfccu.org.

Roger Heidlebaugh serves as Vizo Financial’s portfolio strategist. He acts as an investment consultant for credit unions, helping them to manage their fixed income investments, jumbo CDs and deposit accounts. On the corporate side, he analyzes, monitors and facilitates liquidity funding and investment solutions for Vizo Financial. Mr. Heidlebaugh is well-versed in the financial services industry, with over 14 years of experience as a financial advisor and expertise in managed accounts, various annuities, life insurance, investments and more.